FTSE 100 Competition Results week 12

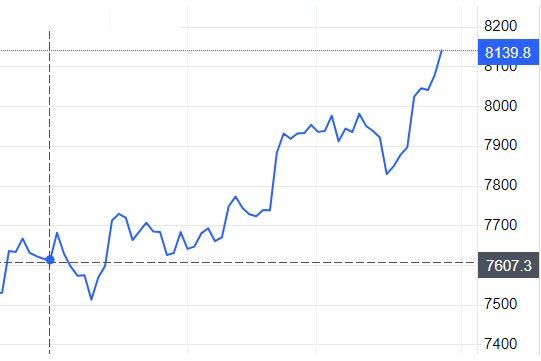

Our competition closed with the FTSE 100 at a record high

FTSE 100 opened the week on 7895.85

FTSE 100 closed the week on 8,139.83

Following three straight weeks of falling prices, stock indices regained some lost ground this week as there were signs that tensions in the Middle East have eased, after missile strikes between Israel and Iran last week, which helped oil prices retreat.

Analysts credited the rise on a weakening in the value of the pound against the US dollar. Sterling is trading at five-month lows against the dollar, at just $1.23. The FTSE 100 contains many large international companies whose earnings are generated in dollars but reported in pounds, meaning they become more profitable when the dollar strengthens. This benefits UK-based investors and means London stock markets are given a boost.

The market prices also reflect that investors think things will continue to improve. Optimism is high that the economy will return to growth this year, after falling into a shallow recession at the end of 2023, which is also boosting UK stocks. Hopes have grown in recent months that the Bank of England will cut interest rates over the summer months as inflation beats a retreat.

The FTSE 100 was pulled higher by a raft of strong earnings reports and renewed takeover activity. Primark owner Associated British Foods was up 7.68% after profits jumped more than a third at its half-year results. BHP’s takeover tilt for Anglo American drove shares in the mining firm sharply higher and helped boost the FTSE.

Anglo American ended up our best performing shares during the last 12 weeks (up 55.23%) as it rejected a £31.1 billion plan to create the world’s largest copper miner after being approached by Australian rival BHP. The company’s board said that BHP’s proposal “significantly undervalues” the business and its “future prospects.”

The FTSE 100 was also boosted by a strong reception to NatWest’s latest trading update.

FTSE 100 biggest risers

Anglo American +21.29% (Blockbuster £31bn bid from rival BHP)

NatWest +11.10% (Results up as mortgage applications rise)

Barclays +9.96% (Bank posts solid first quarter results)

Ashtead Group +9.82% (Stock near all time high on broker upgrade)

AstraZeneca +9.52% (Demand soars for AZ’s cancer drugs)

FTSE 100 biggest fallers

ConvaTec -8.78% (Concern at wound care market hit rating)

Entain -6.35% (Upcoming regulation weighs on bookie)

DS Smith -5.19% (Packager loses steam after bidding war)

Legal & General -4.17% (Volatile trading hurts investment firm)

Schroders -3.60% (Boss to retire next year after a decade)

In our competition all but three entrants made gains this week. Those holding Anglo American in particular made good progress. Mover of the Week with a gain of £3514 in one week, was Maureen Walters up 15 places to 14th. Furthest to slip this week was Roths Child down £171 and 10 places to finish 50th. Biggest loser of the week was last two week’s leader, Comrie Colliery down £1005 and to sixth place.

At the end of our 12 week contest all but five of our 57 entrants made gains but the winner with a profit of £8912 was Petroc Properties. Well done to Petroc who was placed 56th in week three! The top 12 remained the same as the previous week with our winner moving up from third to win. Jim Aitken retained the runners up spot and Dalgety47 made a late run to move from tenth to third.

At the foot of our leaderboard the bottom seven entrants remained the same and despite a good gain on the week of £1264, Dolphin Square held on to the bottom spot to win the bottle of malt whisky.

Looking back over the 12 week period of our Fantasy FTSE 100 contest the best stocks to have held would have been as follows:-

Anglo American +55.23%

Nat West Group +45.89%

Barclays +43.63%

Antofagasta +37.33%

Endeavour Mining +32.58%

Rolls Royce Holdings +32.38%

And just to remind you that share prices can go down as well as up, the poorest performers over the last 12 weeks were:-

St James Place plc -31.63%

Ocado Group -31.30%

Reckitt Benckiser Group -23.08%

Entain plc -22.39%

Whitbread plc -12.61%

Flutter Entertainment-11.65%

Thank you for entering our fundraiser, I hope you enjoyed the journey. The activity will have raised £440 for the Rotary Club of West Fife’s charitable activities.